The Bitcoin Perfection Problem

Bitcoin has an intractable problem, and it is intrinsic to bitcoin itself.

The history of every industry is the story of producing more, with less. Fewer resources and less labor go into everything. From raw materials, to factory machines, to consumer goods, to distribution, and retailing there have been relentless gains in efficiency and relentless reductions in cost. Historically, food was so expensive that French kings in the 17th century and American politicians in the first half of the 20th promised a “chicken in every pot.” Today food is so cheap that obesity, not starvation, is the big nutrition problem among the poor.

The process of improving production is a journey, not a destination. No one believes that the amount of wheat grown per acre has been perfected, and that’s it. No one thinks that fertilizer cannot be improved, or that harvesting cannot be further automated. No one claims that computers have become as fast and as capable as they ever will, and that software won’t be improved. And obviously, no one asserts that the speed limit for commercial air travel is 500 miles per hour. There are now several companies working on supersonic aircraft. Not to mention, space travel.

So bitcoin is an interesting social phenomenon. The technology is clever—but then, so is the technology for harvesting grain by the square mile, making chips that run at 3 GHz, and airplanes that can fly 1,000 mph. No, the point here is the social phenomenon itself.

The Social Phenomenon of Bitcoin

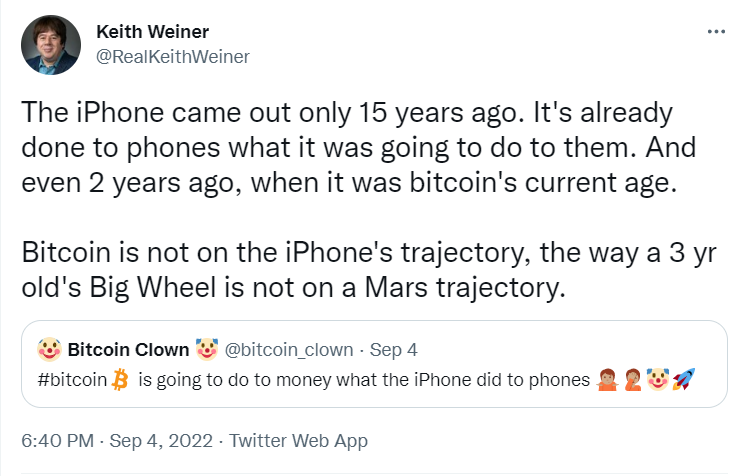

Bitcoin promoters believe that bitcoin technology is the final destination, not a journey. That everything man knows—everything man can know—about monetary computer networks was incorporated into bitcoin. Bitcoin is a summit that will not be surpassed, because it cannot be.

And for them, this is a necessary premise. It is necessary, because if the technology could be improved incrementally, let alone if there could be further revolutionary developments, then bitcoin itself could be abandoned in favor of the next new kind of cryptocurrency.

Could there be some sort of transition for holders of bitcoin to end up with the equivalent amount of the new cryptocurrency which replaces it? Maybe. It would depend on the nature of the new technology. Suppose Ethereum were gaining market share at an accelerating pace, perhaps due to its smart contract capability. Would there be a way to convert $50,000 worth of bitcoin to $50,000 worth of Ethereum? Obviously not. Note we cannot just say that all bitcoin holders sell their bitcoin to buy Ethereum. The attempt would crash the bitcoin price. Only a few on the leading edge could exit with their value intact.

Bitcoin’s Perfection Complex

A graceful bitcoin conversion would also depend on the incentives that motivate the various players. No one cares about your wealth. They care only about their own. They do not exist to ensure that you retain your value in a transition. What happened to those who were invested in making buggy whips, when internal combustion engine technology was adopted?

If the big node operators of the bitcoin network collaborated on a new version of the bitcoin protocol, then maybe all existing holders would stay even. But if a new technology emerged from new innovators (which is often how it goes), then bitcoin holders could lose everything.

Thus, their implicit premise is that bitcoin has perfected the technology, and it shall remain static until the end of the world. A change, much less a revolutionary change, poses an unacceptable financial risk to those who trade their life savings for bitcoin, those who put their house in hock to buy bitcoin, and those who turn their software companies into leveraged bitcoin hedge funds. The idea of a change poses an unacceptable psychological risk.

If new innovations are possible, and if those new innovations are not plug-compatible with bitcoin, or if they are developed independently by new players who are not interested in giving a trillion dollars’ worth of their new cryptocurrency to those who happened to bet on the obsolete cryptocurrency 1.0… well, that just can’t be possible!

The Technology of Bitcoin

Finally, let’s look at bitcoin’s technology, through the lens of the constant drive to improve efficiency. Maintaining the bitcoin network consumes enormous amounts of energy. And requires enormous amounts of capital in the form of the hardware that crunches the numbers. In any other industry, producing any other good or service, inventors, innovators, engineers, entrepreneurs, and investors would be hammering on this problem. For example, look at the internal combustion engine. Today, engines produce more horsepower, using less fuel.

Or look at dairy production. An acre of land supports more cows, and each cow gives more milk. And each cow requires less labor. This labor is freed up to work on producing other things, that 18th century agrarian societies could not have imagined.

But bitcoin has a problem in this regard. The enormous cost of operating the network is not incidental. It is not waste, per se. It is designed into bitcoin, part of bitcoin’s very nature. Bitcoin operates on a principle, called “proof of work”, which is central to how the disparate operators of its network nodes agree on every transaction. If they did not agree, then a bitcoin could have multiple holders. The system would not work. You could not eliminate proof of work—or the computational work—from bitcoin, the way you could not remove moving parts from an internal combustion engine. The way you could not remove dairy from cheese. The way you could not remove production from the economy.

In computers, work means performing calculations. And calculation requires electricity. The amount of electrical energy consumed to calculate a single thing (e.g. the sum of two numbers) has been going down since the dawn of the computer age. In the 1950’s, a computer had thousands of vacuum tubes. It was large enough to fill a room, and required 240 volt power. Today, the supercomputer in your pocket (i.e. mobile phone) has more computing power than the entire world had in 1975. It requires so little power, that a small battery can keep it running all day.

A Trillion Dollar Bet

However, bitcoin was designed to use more and more computing power as time goes on. At first, someone with a personal computer could operate a node profitably. Today, one needs a lot more computing power. And even though the electricity per calculation has decreased significantly in the last decade, the amount of electricity you need to operate a successful bitcoin node has increased. By a lot.

This power-burning arms race is inherent in bitcoin’s “proof of work” architecture. You see, the purpose of performing all those calculations is not because the output is otherwise useful. The work itself, the very need to do this work, is intrinsically necessary to operation of the bitcoin network.

Bitcoin depends on large numbers of people performing large numbers of computations. And the number of transactions is rising, along with the amount of hardware required, and the amount of electricity burned.

It is this, that bitcoin promoters promote as being the end of progress, the pinnacle from which no further progress is possible. And they have a trillion-dollar bet riding on this premise.

********

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the Gold Standard Institute USA. Keith is a leading authority in the areas of gold, money, and credit and has made important contributions to the development of trading techniques founded upon the analysis of bid-ask spreads. Keith is a sought after speaker and regularly writes on economics. He is an Objectivist, and has his PhD from the New Austrian School of Economics. His website is

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the Gold Standard Institute USA. Keith is a leading authority in the areas of gold, money, and credit and has made important contributions to the development of trading techniques founded upon the analysis of bid-ask spreads. Keith is a sought after speaker and regularly writes on economics. He is an Objectivist, and has his PhD from the New Austrian School of Economics. His website is