Bitcoin: Torn Between Bull Runs And Bear Plunges, Extreme Volatility Ahead

As we enter 2025, Bitcoin finds itself at yet another critical juncture, navigating a complex landscape of unprecedented institutional interest, regulatory shifts, and market expectations. The cryptocurrency has already surpassed the USD 100,000 milestone, yet analysts unanimously predict a year of dramatic price swings. With price target projections ranging from USD 150,000 to USD 200,000, Bitcoin stands poised between exhilarating bull runs and potential sharp corrections, embodying the inherent volatility that has defined its remarkable journey. The current market dynamics suggest a perfect storm of factors—including spot ETF inflows, potential U.S. strategic reserve considerations, and nasty waves of profit taking in the stock market, that could propel Bitcoin to new heights while simultaneously exposing it to significant market turbulences.

Review

Over the last eight weeks, Bitcoin was able to break out above its resistance zone between USD 73,000 and USD 75,000 as expected. Consequently, Bitcoin prices then rose significantly and reached one new all-time high after another. On December 5th, Bitcoin exceeded the USD 100,000 mark for the first time!

However, after reaching a new all-time high of USD 108,100 on December 17th, Bitcoin has experienced a notable correction. Over the last two weeks of 2024, the cryptocurrency came under increasing market pressure, eroding its previous bullish momentum and pulled all the way back to USD 91,315, representing a decline of approximately 15% from its peak. Overall, Bitcoin’s price action in 2024 underscored its characteristic volatility and resilience. Despite the late December pullback, Bitcoin still managed to end 2024 with an impressive 123.4% increase in its market cap, solidifying its position as the 7th largest global asset.

Correspondingly, the start of 2025 has brought renewed optimism to the crypto market. Bitcoin bulls have regained control, pushing the price back above the psychologically important USD 100,000 mark. As of January 7, 2025, Bitcoin is trading at approximately USD 101,835, demonstrating a strong recovery from its year-end lows.

Post election pump

Looking back, Donald Trump’s US election victory was probably the decisive catalyst for the significant increase (“Trump trade”) in November. Donald Trump can definitely be called the “Bitcoin President” after previously making a remarkable U-turn in his stance on cryptocurrencies. Just in time for the US election, he opportunistically positioned himself as a strong supporter of Bitcoin and promised to make the US a “Bitcoin superpower”.

At the Bitcoin Conference 2024 in Nashville, he announced that he would loosen the regulatory environment for cryptocurrencies and set up a “Bitcoin and Crypto Advisory Board” in the first 100 days of his term. He also announced plans to build a state strategic reserve for Bitcoin, similar to the existing reserves for gold and oil. In addition, Trump is personally involved in crypto projects, which further underlines his positive attitude towards cryptocurrencies. These developments have made him a central figure in the current Bitcoin boom.

Game Theory Dynamics Propelling Bitcoin’s Momentum

Whether these developments will be beneficial in the long term remains to be seen. However, given Bitcoin’s unprecedented presence and political relevance, the growing influence of Bitcoin is creating a complex game theoretical landscape that compels influential players to take the cryptocurrency seriously. This dynamic is driven by several interconnected factors:

- Institutional Domino Effect: As major institutions adopt Bitcoin, it creates a cascading effect where others feel compelled to follow suit to avoid being left behind.

- Political Legitimacy: Support from the new U.S. administration lends Bitcoin additional legitimacy and credibility, making it riskier for governments and corporations to ignore or dismiss the technology.

- First-Mover Advantage: The potential economic benefits of early adoption exert pressure on decision-makers to engage with Bitcoin proactively.

- Opportunity Cost: Global attention on Bitcoin raises the stakes of inaction, as significant developments and opportunities could be missed by those who choose to remain on the sidelines.

- Network Effects: As Bitcoin’s user base grows, its utility and value proposition strengthen, further incentivizing adoption.

These factors collectively create a game theoretical scenario where ignoring Bitcoin becomes increasingly untenable for many players. While the long-term implications of these developments remain uncertain, the current dynamics are undeniably accelerating Bitcoin’s integration into mainstream finance and politics.

Technical Analysis for Bitcoin in US-Dollar

Weekly Chart: First cup-and-handle price target already achieved

Bitcoin in USD, weekly chart as of January 7th, 2025. Source: Tradingview

Starting from the crash low on August 5th at USD 49,577, Bitcoin was able to rise by around 120% over the last five months. The breakout above the resistance zone between USD 73,000 and 75,000 in November brought the final end to the tenacious consolidation phase that had lasted several months. This breakthrough caused a sharp rally and overran all obstacles. In a manner typical for Bitcoin, there was a direct march through to the first price target from the large cup-and-handle formation at USD 98,000 to USD 100,000. The second price target from this formation at USD 130,000 is still pending, however, and could be targeted in the course of 2025.

Interestingly, the sharp pullback over the last two weeks in 2024 has not led to a sell signal on the weekly stochastic oscillator. Accordingly, the breather might already be over. Alternatively, however, the entire leg up of the last five months will be corrected. In particular, the weakening stock markets and the faltering Bitcoin dominance, which briefly fell significantly at the beginning of December, suggest a somewhat larger pullback might still be possible.

Bitcoin CME future contract with open gap

Bitcoin Future in USD, weekly chart as of January 7th, 2025. Source: Tradingview

In the Bitcoin CME future contract, the explosive Trump rally has left an open price gap between USD 77,930 and USD 80,670. It wouldn’t be surprising if this price gap still needs to be closed. This could test the successful breakout from the cup-and-handle formation, and subsequently, the continuation of the Bitcoin rally would stand firmly on two legs.

Overall, the weekly chart remains bullish. The overarching uptrend is clearly established and not at risk. However, the weakness in the second half of December, combined with the roller coaster ride in the stock markets, calls for some caution. After all, thanks to Wall Street and the numerous Bitcoin ETFs, the Bitcoin price is more closely correlated than ever before with the fate of the stock markets.

Daily Chart: Strong support zone above 90,000 USD

Bitcoin in USD, daily chart as of January 7th, 2025. Source: Tradingview

On the daily chart, Bitcoin slipped below its 50-day line (USD 97,727) after Christmas and gradually slipped further into the broad support zone around USD 90,000. The low of this pullback was seen at USD 91,315. In the meantime, however, Bitcoin prices have already recaptured the rising 50-day line as well as the round mark of USD 100,000.

Although the bears tried hard for 16 trading days, they have only made very slow and sluggish progress. As a result, the stochastic oscillator has penetrated deep into its oversold zone. The bounce since the beginning of the year immediately generated a new buy signal and the stochastic oscillator still has quickly reached its overbought zone again. As well the upper Bollinger Band (USD 101,947) has been reached. Accordingly, after a quick and impressive bounce, the air is getting a bit thin again for Bitcoin. However, if the low, seen on December 30, 2024, was a larger turning point, Bitcoin should already be on its way to new all-time highs.

Overall, the daily chart is bullish thanks to the recent stochastic buy signal. However, the daily chart is overbought too. Hence, we would not be surprised if Bitcoin needs some time to digest the bounce of the last seven days.

Bitcoin Sentiment – A bit too optimistic

Crypto Fear & Greed Index, as of January 2nd, 2025. Source: Bitcoin Magazine Pro.

The “Crypto Fear & Greed Index” is currently at 70 out of 100 points. The pullback had at least partially cooled the mood in the last two weeks of 2024. However, there is certainly not a contrarian buy signal.

CMC Crypto Fear & Greed Index, as of January 4th, 2025. Source: Coinmarketcap

In CoinMarketCap’s “CMC Crypto Fear & Greed Index”, sentiment had shifted significantly more towards “neutral”. Thanks to the recovery of the last few days, the sentiment barometer is again in the “greed range”.

Overall, the current market sentiment requires a differentiated view. Despite the significant price drop to around USD 91,351, the general mood among investors remained too optimistic. At the same time, the pullback created enough skepticism for a significant price recovery.

On top, Jim Cramer and Christian Lindner are also causing skepticism. The former German finance minister has spoken out in favor of a Bitcoin reserve for the European Central Bank (ECB), which puts him in the steadily growing circle of political actors who are opportunistically joining the Bitcoin herd instinct. This development is strongly reminiscent of the end of the Bitcoin euphoria of 2021, when numerous public figures demonstrated their support for Bitcoin by using “laser eyes” in their social media profile pictures.

Bitcoin Seasonality – Seasonality turns neutral to slightly negative

Bitcoin Seasonality as of January 4th, 2025. Source: Seasonax

Bitcoin has adhered to seasonal guidelines in an exemplary manner last year. Since the new all-time high in March, prices have corrected and, as expected, reached an important low of just under USD 50,000 at the beginning of August. After a tenacious bottoming phase in August and September, the next wave up began in mid-October.

In the past, however, the turn of the year usually brought somewhat weaker prices for January. According to the seasonal pattern, the pullback that begun in mid of December could therefore continue until the end of the month.

In summary, the seasonal component in the first few weeks of the new year is somewhat unfavorable for Bitcoin.

Sound Money – Bitcoin vs. Gold. Bitcoin – Torn Between Bull Runs And Bear Plunges, Extreme Volatility Ahead

Bitcoin/Gold-ratio, daily chart as of January 7th, 2025. Source: Tradingview

With prices of around USD 101,800 for one Bitcoin and around USD 2,640 for one troy ounce of gold, you currently have to pay almost 38.5 ounces of gold for one Bitcoin. In other words, one troy ounce of gold currently costs around 0.026 Bitcoin. This means that gold has lost around 28% against Bitcoin in the last two months alone! With a double low on August 5th and September 6th in the area of 21.5, the Bitcoin/gold-ratio had found the end of its six-month correction in the summer. Since then, the ratio has risen by almost 93% in favor of Bitcoin. With spikes towards around 41, the ratio surpassed its two all-time highs from 2021 at around 37 clearly.

Overall, the Bitcoin/gold ratio confirms the strong buy signal for Bitcoin against gold. The pullback from 41 to 35.5 in the last weeks of 2024 had created a strongly oversold situation on the daily chart, from which Bitcoin was able to recover quickly against the gold price. On the weekly chart shown, the uptrend is intact and the stochastic oscillator continues to move bullishly embedded above 80 with both signal lines.

Macro Update – Highly complex situation is likely to bring significantly increased volatility for 2025

Shanghai Shenzen CSI 3000 Index, as of January 2nd, 2025. Source: Holger Zschäpitz

At the start of the new year, the Chinese CSI 300 Index recorded its sharpest decline on the first trading day since 2016, with a daily loss of 2.9%. Given that the CSI 300 lost 11.3% overall in 2016, this first trading day could be indicative of the year’s trend. The German DAX also experienced a wild roller coaster ride on the first two trading days, not making the healthiest impression. The Dow Jones is already trading about 5.3% below its all-time high from December 4th, while the S&P 500 and especially the NASDAQ appear somewhat more robust.

Bitcoin corrects 15% within two weeks

Bitcoin retreated from its new all-time high by a substantial 15% to USD 91,315 in less than two weeks, but is now back above the psychological mark of USD 100,000. So far, this looks like a normal consolidation or healthy pullback around this major psychological level.

US stocks against gold, as of December 31st, 2024. Source: Bloomberg Intelligence

Gold, on the other hand, has been demonstrating fundamental strength throughout 2024. In mid-December, as expected, support around USD 2,600 was successfully defended again. Gold not only convinces with new upward momentum at the start of the year, but has been outperforming the S&P 500 since 2021. This fact increasingly points to deflationary tendencies in the global financial system as a possible early indicator. Whether the precious metal will beat stocks again in 2025 could therefore be one of the most important macroeconomic questions. The current situation, after the fading of the major Covid liquidity injections, is quite similar to the dangerous situations of 1999/2000 and 2006/2007. Gold’s resilience and fundamental strength remain remarkable, having held up well despite the significantly stronger US dollar in recent weeks and merely consolidating sideways the gains made since late October.

Jim Rogers and Warren Buffett have drastically reduced their US stock exposure

Overall, global financial markets are facing increased risk and susceptibility to profit-taking after the steep and partially bubble-like price increases in US tech stocks. Hence, significantly increasing volatility is likely to make life much more difficult for investors across all asset classes this year. However, if strong turbulence causes enough skepticism and uncertainty, the year-end balance could still show a plus in the stock markets thanks to loose monetary policies around the globe. At least in the short term, the upcoming change of power in America could cause the stock and especially the crypto markets to boom again in the course of the “post-election pump”.

Overheated US tech stocks are vulnerable in 2025

Buffett Indicator, as of September 30th, 2024. Source: Gramalam, LLC.

Nevertheless, Jim Rogers and Warren Buffett, two of the world’s best-known investors, have recently drastically reduced their US stock quotas. These two completely independent decisions are based primarily on the assumption of an overvaluation of US stock markets and the fear of an impending recession in the US. Rogers warns of a “very bad” economic crash due to the increased global debt burden, while Buffett’s famous “Buffett Indicator”, which measures the ratio of stock market value to GDP, points to significant overvaluation. Both investors follow the principle of being cautious when others are greedy.

Yield curve model, as of September 30th, 2024. Source: Gramalam, LLC.

Their caution is reflected in concrete actions: Rogers has sold all his US stocks and is even considering shorting stocks, while Buffett has been a net seller of stocks for eight consecutive quarters. Buffett has also sold his positions in companies such as Floor & Decor Holdings, Paramount Global, and Snowflake. Instead, he is diversifying his portfolio by investing in other sectors. For example, he bought the railroad company Burlington Northern Santa Fe for USD 44 billion. These risk minimization measures and the search for alternative investment opportunities underscore the concern of these two renowned investors about current market conditions and valuations in the US stock market.

10 stocks account for 40% of market capitalization

Trade wars are easy to win. Source: Poet Writers Group

Indeed, the current indicators surrounding US financial markets exceed anything known so far. Just 10 stocks make up 40% of the S&P 500’s market capitalization, while the huge US stock market itself represents almost 50% of the entire planet’s market capitalization. Based on yields, investors consider these stocks a safer bet than 10-year US Treasury bonds, a measure not seen in 50 years. Moreover, Trump’s planned US tariffs could significantly unsettle investors and affect the global export economy. A protectionist trade policy always exacerbates international trade tensions and endangers the global economy. In addition, increased production costs due to import tariffs can reduce the profitability of companies and fuel consumer prices.

Should there be a deflationary shock or even a bear market in the stock markets, not only these tech stocks but especially the Bitcoin price would be at very high risk. After all, Bitcoin is more closely correlated with US stock markets than ever before. In particular, the election of Donald Trump as US President and his crypto-friendly stance have positively influenced both the crypto and traditional financial markets. At the same time, the introduction of Bitcoin spot ETFs in the US has made it easier for institutional investors to invest in Bitcoin, closely intertwining it with the traditional financial sector.

Macroeconomic factors such as US monetary policy now equally influence both markets, with loose monetary policy naturally favoring risky assets like Bitcoin. Moreover, the Bitcoin market is increasingly following the 4-year cycle of the US presidential campaign, which also influences stock markets. The growing perception of Bitcoin as an alternative store of value contributes to the cryptocurrency reacting more strongly to macroeconomic factors that also affect stock markets.

Increasing Divergence Between East and West

In contrast, the other half of the world’s population in the eastern part of the planet (China, Russia, and India, or Asia, the Middle East, and parts of Africa) is increasingly distancing itself from Western values, treaties, and trade relations, opting instead to purchase physical gold. This growing divergence between the East and the West in terms of economic strategies and asset preferences is a complex phenomenon that is likely to shape both financial and geopolitical landscapes in the coming years and possibly decades. While central banks in Asia and Eastern Europe are increasingly emerging as major gold buyers, and countries such as South Sudan, Zimbabwe, and Nigeria are increasing their gold reserves to protect against currency losses, the West is focusing more on technological innovations and digital assets.

Bitcoiners 2013 vs Bitcoiners 2024. Source: Internet Meme

Thanks to high investments in future technologies and digitalization, the West is experiencing a new “founding era”, which, however, primarily leads to high growth rates and new corporate giants in the USA and Asia.

The future will show which strategy proves to be more sustainable. In any case, this divergence intensifies geopolitical tensions and growing mistrust between East and West. Possibly, a combination of both approaches – stability through traditional assets like gold and innovation through technology and digital assets – will be the key to balanced global economic development and a new economic order.

In particular, there is an urgent need in Europe and Germany to unleash new innovative power through free markets and deregulation while simultaneously ensuring the stability of economic systems. Otherwise, Germany and Europe will have no chance in global competition.

Conclusion: Bitcoin – Torn Between Bull Runs And Bear Plunges, Extreme Volatility Ahead

Driven by technological advancements, regulatory developments, and changing market dynamics, the crypto industry will continue to evolve at a breathtaking pace in 2025. Artificial Intelligence (AI) will play a key role in reshaping the crypto landscape, with AI agents potentially owning their own wallets, autonomously conducting transactions, and even managing blockchain networks. This convergence of AI and blockchain is expected to contribute an estimated USD 1.76 trillion to global GDP by 2030, revolutionizing areas such as decentralized finance (DeFi), predictive analytics, and fraud prevention.

Proof-of-Personhood (PoP) systems are likely to gain significance this year to verify human uniqueness and combat deepfakes and fraud attempts. These systems aim to establish digital identities while preserving privacy, possibly utilizing advanced technologies such as iris recognition.

A surge in stablecoin adoption is anticipated, with businesses from small cafes to global corporations using crypto infrastructure to reduce transaction costs. However, USDT (Tether) has disappeared from most European crypto exchanges as of December 30th, 2024, due to MiCA regulations. So far, the consequences for crypto trading in Europe have been manageable.

Decentralized Autonomous Chatbots (DACs) could become a potential growth driver. Chatbots operating on decentralized and permissionless systems, coordinated through a consensus protocol, could create the first truly autonomous billion-dollar company in the bot economy through the integration of artificial intelligence with blockchain technology.

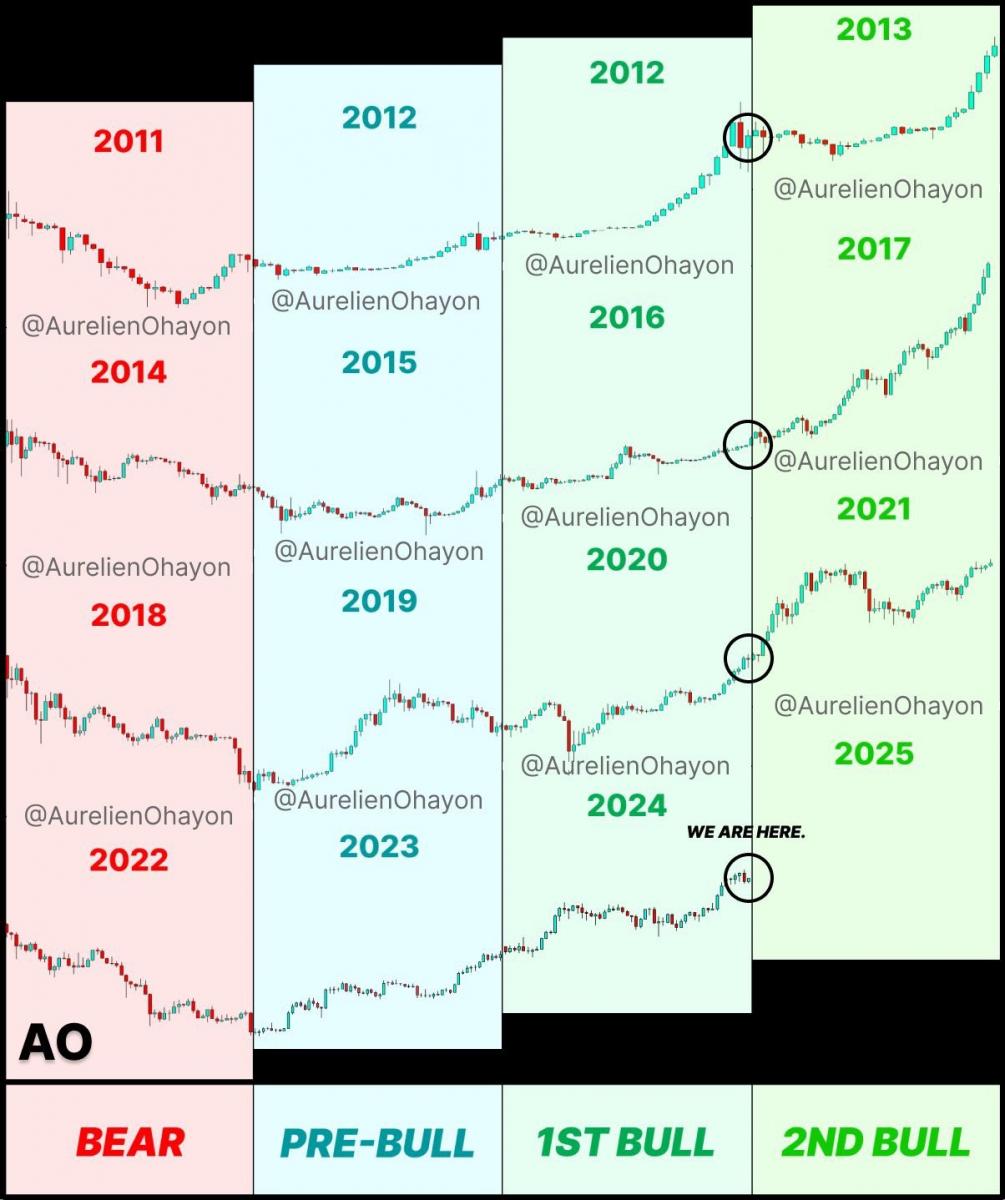

Bitcoin 2nd Bull-run within the cycle. Source: AurelienOhayon

Pricewise, Bitcoin is likely to move in a large trading range between approximately USD 70,000 and USD 150,000 this year. We are confident that the second price target from the four-year cup-and-handle pattern at around USD 130,000 can be reached during the course of this year. However, we fear that the volatility will become extreme. Hence, our title Bitcoin – Torn Between Bull Runs And Bear Plunges, Extreme Volatility Ahead.

The “January 7th, 2025, Bitcoin – Torn Between Bull Runs And Bear Plunges, Extreme Volatility Ahead” analysis is sponsored and initially published on January 4th, 2025, by www.celticgold.eu. Translated into English and partially updated on January 7th, 2025.

Join us in our free Telegram channel for daily charts, real time data and a great community. If you like to get regular updates on precious metals, commodities, and bitcoin, subscribe to our free newsletter.

Disclosure:

This article and the content are for informational purposes only and do not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts, and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.

******