Bullish Picture For The USD & Stocks And Its Implications For Gold & Silver

The latest World Gold Council Gold Demand Trends report shows that the gold market is driven by diverse global demand, and the appetite for owning gold jewelry, bars and coins continues to grow.

“The price drop in April, fuelled by non-physical moves in the market, proved to be the catalyst for a surge of buying that has left many retailers short of stock and refineries introducing waiting lists for deliveries,” said Marcus Grubb, Managing Director of Investment at the World Gold Council. “What these figures show is that even before the events of April, the fundamentals of the gold market remain robust with; growing demand in India and China, central banks consistently adding gold to their reserves and strong buying of investment products such as gold bars and coins.”

The report, for the period between January-March 2013, shows that total jewelry demand was up 12% year-on-year in Q1 2013, driven mainly by Asian markets. For example, jewelry demand in China was up 19% on the same period last year and stood at a record 185 tons. Demand in both India and the Middle East was up 15% respectively and in the US, demand showed a significant increase, 6%, for the first time since 2005.

Demand for gold in China and India was also fuelled by an increase in bar and coin sales - up 22% year-on-year in China and a whopping 52% in India. The US also saw a growing hunger for bars and coins-- up 43% compared with the same quarter in 2012.

There’s significant investment demand for physical gold bullion at the current prices – what does it mean for the market? That it’s going higher in the long run and that the current move down is just a correction. It doesn’t imply, however, that the bottom is already in or that it will form without additional temporary downswing.

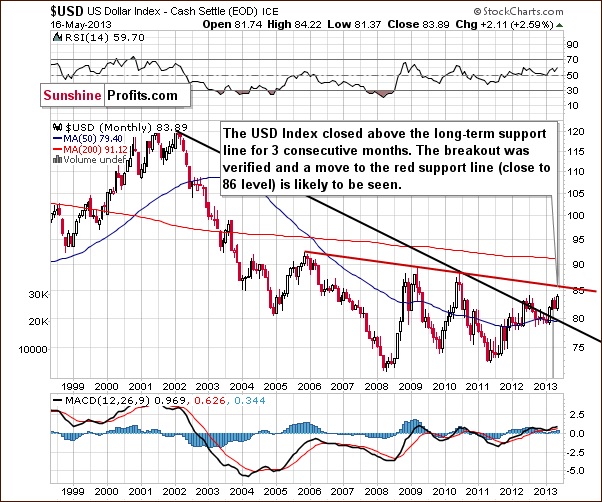

To gain some insight into short- and medium-term picture of the market, let's take a look at the charts. In today’s essay we will discuss the implications of the current situation in the USD Index and the general stock market for, gold, silver and mining stocks, and we will also provide a follow-up to our recent essay on gold stocks and gold. We will start with the very-long-term USD Index chart (charts courtesy by http://stockcharts.com.)

In this chart, we see that more moves to the upside took place this week. As we stated in our essay of two weeks ago ( https://www.gold-eagle.com/editorials_12/radomski050313.html ):

The index has actually confirmed a breakout above the very long-term resistance line. It has closed above it now for three consecutive months (yes, months). While a correction to the 80 level is still possible in the short term, aneventual move to the upside is now more likely than not.

This week’s price action was in tune with what we expected after the recent breakout and the situation remains bullish.

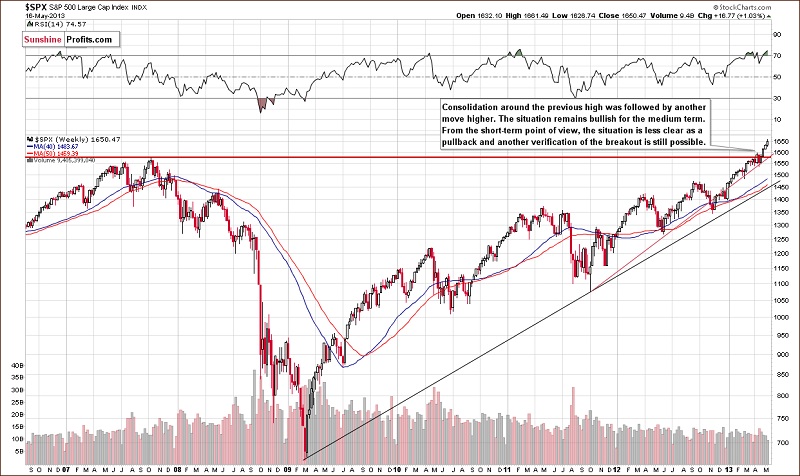

Let us move on to the general stock market.

The stock market (S&P500 Index in this case) continues to move higher this week as expected. The situation is overbought on a short-term basis, but we do not expect to see a move below 2007 high. If anything, we could see stocks move back to this level, which could further verify the breakout and allow them to gather strength in advance of the next rally. After all, the breakout above the 2007 high was confirmed.

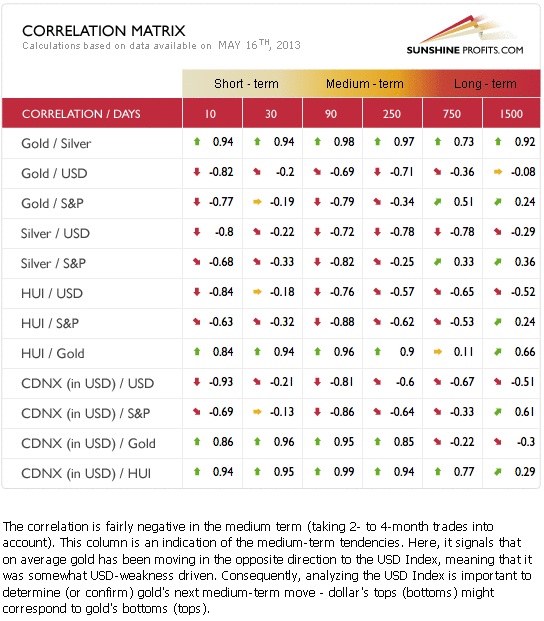

To see how the situation in the USD and stocks may translate into the prices of gold and silver, we now turn to the intermarket correlations.

The Correlation Matrix is a tool which we have developed to analyze the impact of the currency markets and the general stock market upon the precious metals sector, (namely: gold correlations and silver correlations).

The short-term situation here is mixed and no real implications can be drawn at this time. The medium-term correlations are negative for the precious metals with both the USD Index and the general stock market. The precious metals are still pretty much anti-asset at this time. The medium-term odds, which favor a rally in the USD Index and the general stock market, have now painted a bearish picture for gold, silver and the precious metals mining stocks.

To finish off, let us have a look at the situation in gold stocks relative to the yellow metal itself.

On the above chart, the situation hasn’t changed much this week. Hence, comments made in last week’s essay ( https://www.gold-eagle.com/editorials_12/radomski051013.html ) remain up-to-date at this time and the bearish outlook continues to be supported by this chart:

The trading channel and the next horizontal support intersect at a point much lower than where this ratio is today. Of course, the existence of a target level by itself is no indication that it will be reached; the trend has to be in place as well. The point here is that the ratio has already broken below the previous late 2008 major low and is now a bit more than 5% beneath it. This is a major breakdown and it was confirmed. The implication is that the trend is still down.

With the trend being down and accelerating and the recent breakdown being confirmed, there is a good possibility that the miners will decline significantly once again. This makes the previously mentioned target level a very important one. At this time it seems likely that the ratio will move to its 2000 low – close to the 0.135 level.

If gold stocks decline relative to gold as they did late in 2000, and gold declines to $1,300 or slightly higher, the target level for the HUI Index would be slightly above the low of 2008 – around the 180 level.

Summing up, the long-term and medium-term outlook is bullish for the USD Index at this time. As for stocks, the situation remains bullish for the medium term, and although a short-term correction is likely not too far off, we don’t expect to see it immediately. Finally, gold stocks’ performance relative to gold continues to provide us with bearish indications. Overall, it seems that the final bottom in the precious metals market is not yet in.

To make sure that you are notified once the new features are implemented, and get immediate access to our free thoughts on the market, including information not available publicly, we urge you to sign up for our free gold newsletter. Sign up today and you'll also get free, 7-day access to the Premium Sections on our website, including valuable tools and charts dedicated to serious Precious Metals Investors and Traders along with our 14 best gold investment practices. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great and profitable week!

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks andsilver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.