Money Supply & Monetary Base Fuel The Price of Gold and Silver

BANK ON GOLD AND SILVER VALUES TO REACH RECORD LEVELS IN THE NOT TOO DISTANT FUTURE…year after year – as global Central Banks try to inflate away their burgeoning debt and reduce unacceptably high UNEMPLOYMENT by vastly expanding Money Supply. Here is a comprehensive analysis of how Money Supply affects the Price of Gold: “MONEY SUPPLY vs The Price Of Gold.”

https://www.gold-eagle.com/editorials_12/drdoolittle022713.html

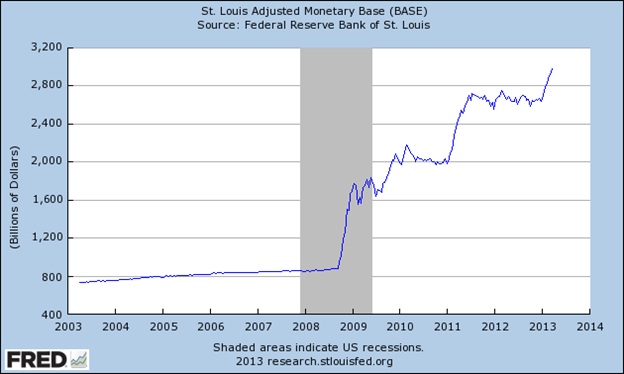

Monetary Base (2009-Present)

During the past 4 years of Obama’s Presidency, the Monetary Base has exploded upward at a Compounded Annual Rate of +33.1% (CAGR). This is unprecedented as the Monetary Base is GROWING 7 TIMES FASTER THAN ITS 4.7% CAGR during the previous 30 years (ie since 1980).

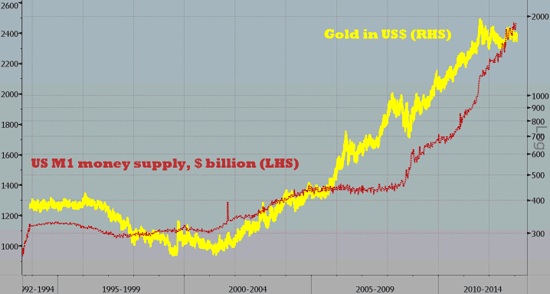

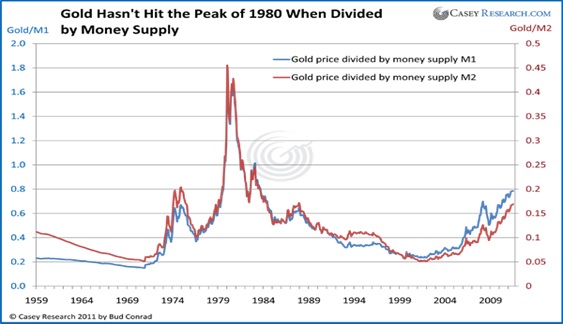

The following charts are also irrefutable evidence that Money Supply is one of the primary factors propelling the price of gold higher.

Money Supply vs Gold price (1992-2013)

Gold Divided By Money Supply (1959-2012)

Price of Gold (2001-2013)

Since 2001 the price of GOLD has enjoyed a Compound Annual Growth Rate (CAGR) of +16.5%.

Price of SILVER (2001-2013)

Since 2001 the price of SILVER has enjoyed a Compound Annual Growth Rate (CAGR) of +17.1%.

Realistic Forecasts for the Price of GOLD & SILVER

Forecasts are based upon the assumption that the Obama Administration with help of the U.S. Fed will continue increasing its Monetary Base and Money Supply. Their laudable objective is to reduce the high 7.7% UNEMPLOYMENT RATE down to an acceptable 6.0% within the next four years. This goal has been publicly stated numerous times by Fed Chairman Dr Bernanke. Consequently, it is reasonable to assume the Monetary Base and Money Supply will continue increasing at its heretofore explosive pace. To be sure this will ensure that the price of GOLD and SILVER will continue appreciating at the same CAGR – ie GOLD +16.5% and SILVER +17.1%.

Therefore, one might rationally expect the following values in the next 5 years and 10 years:

GOLD rising to $3,648/oz….while SILVER rising to $66/oz by 2018

GOLD rising to $7,829/oz…while SILVER rising to $145/oz by 2023

But in the case of SILVER, it could get even better. A long-term chart of the Gold/Silver shows the ratio was 17:1 in January 1980:

THEREFORE in the event VERY VOLATIVE SILVER begins to soar vis-à-vis GOLD (as it has done in the past), we could be looking at the following prices for the white metal at the aforementioned corresponding GOLD PRICES and a GOLD/SILVER RATIO OF 17:1:

With gold at $3,648, SILVER MIGHT BE TOPPING $215/oz by 2018.

With gold at $7,829, SILVER MIGHT BE TOPPING $461/oz by 2023.

Needless to say nobody knows the future with certainty. However, an analysis of financial and economic history; complemented by President Obama’s socialist goal of the Widest Distribution of the Nation’s Wealth, and; supplemented by the U.S. Fed increasing the Monetary Base and Money Supply to achieve a substantial reduction in the country’s UNEMPLOYMENT RATE, it may be logically concluded that GOLD and SILVER will soar much higher in the years to come. Moreover, the price of precious metal will receive even more impetus by major world currencies undergoing debasement (ie devaluation) with a view to stimulating their staggering economies – in addition to inflating away their unpayable and mounting National Debt. The monetary weapon of choice to achieve the above is Quantitative Easing (QE).

A TIDAL WAVE OF QE IS BREWING OUT TO SEA IN 2013

With a building gigantic wave of large Quantitative Easing programs by Central Banks; the ECB, Bank of England, U.S. Federal Reserve, Japan Central Bank & China on the horizon, markets should brace for a quantum jump in Equity & Commodities in the second half of 2013…and beyond. It is imperative to remember the ECB encompasses 12 countries (Germany, France, Italy, Spain, Belgium, Greece, Ireland, Luxembourg, Netherlands, Austria, Portugal & Finland).

In light of all the above, the forecasts given here for GOLD and SILVER during the next 5-10 years may indeed be modestly understated.

Dr. Doolittle