Silver Chartbook: Easing War Premium Leads to Healthy Pullback

Since it’s last significant low and turning point at USD 26.40 on August 8th, 2024, silver rallied by more than 32% to a new 12-year high at USD 34.86 on October 23rd. Over the last two weeks, however, the silver market came under severe pressure and has sold off to USD 30.84 as of Wednesday. This sharp decrease particularly gained momentum following Donald Trump’s victory in the U.S. presidential election. We timely had anticipated a profit-taking event in the precious metal prices in our bi-weekly gold analysis as well as in our most recent weekly gold chartbook. Silver Chartbook – Easing War Premium Leads to Healthy Pullback.

The decline in silver prices can be attributed to several factors. Firstly, Trump’s victory strengthened the U.S. dollar, which typically has an inverse relationship with precious metal prices. Secondly, investors began unwinding their safe-haven positions as the presidential race turned out to be less competitive than anticipated, with the outcome not expected to be contested. Additionally, markets started pricing in the possibility of higher interest rates by the Federal Reserve, which tends to limit demand for non-yielding assets like silver. The Republican nominee’s campaign promises of raising tariffs and implementing tax cuts have also fueled expectations of higher deficits and inflation, further impacting silver prices.

Easing War Premium Leads to Healthy Pullback

Most importantly however, we assume that markets have started to pricing in a certain deescalation in geopolitical conflicts. The geopolitical escalation in the Middle East, ongoing conflict in Ukraine, strong Asian physical demand, and BRICS’ move away from the US dollar have been key drivers of gold’s price increase, potentially incorporating a “war premium.” Donald Trump may pursue de-escalation strategies for both Ukraine and Middle East conflicts. For Ukraine, Trump’s advisors propose a “frozen conflict” model with autonomous regions and a demilitarized zone, while Trump criticizes the current situation. A similar negotiation-based approach is expected for the Middle East. Although the actual outcome of Trump’s potential de-escalation efforts remains very uncertain, investors need to consider whether markets might have started pricing in future easing of tensions under a Trump presidency. Hence, the profit-taking in the overbought gold and silver markets came as no surprise.

Silver in US-Dollar, Weekly chart

Silver in US-Dollar, weekly chart as of November 8th, 2024. Source: Tradingview

Since sustainably breaking out of its huge triangle in early April, silver has advanced nicely and consequently. However, it is certainly not (yet) a vertical thrust higher which gold was able to produce upon breaking above ist massive resistance at USD 2,075. Nevertheless, silver is unthreatened in its uptrend which started in October 2022 and has created an increase by 98.50% already.

Since breaking out of its massive triangle pattern in early April 2024, silver has made steady and consistent progress. While it hasn’t (yet) experienced the dramatic vertical surge that gold saw when breaching its significant resistance at USD 2,075, silver’s upward trajectory remains robust and unchallenged. Silver’s current uptrend, which began in October 2022, has yielded a remarkable 98.50% increase already. This sustained momentum demonstrates the metal’s strength in the current market environment.

However, the pullback over the last two weeks has led to a sell signal from the stochastic oscillator. Silver looks like it wants to retreat to one of its supporting uptrend lines. The nearest being a shaky uptrend line which had been broken several times in the last 12 months. More likely seems to be the one currently sitting at USD 29.75, which is moving soon into the strong psychological support around USD 30.

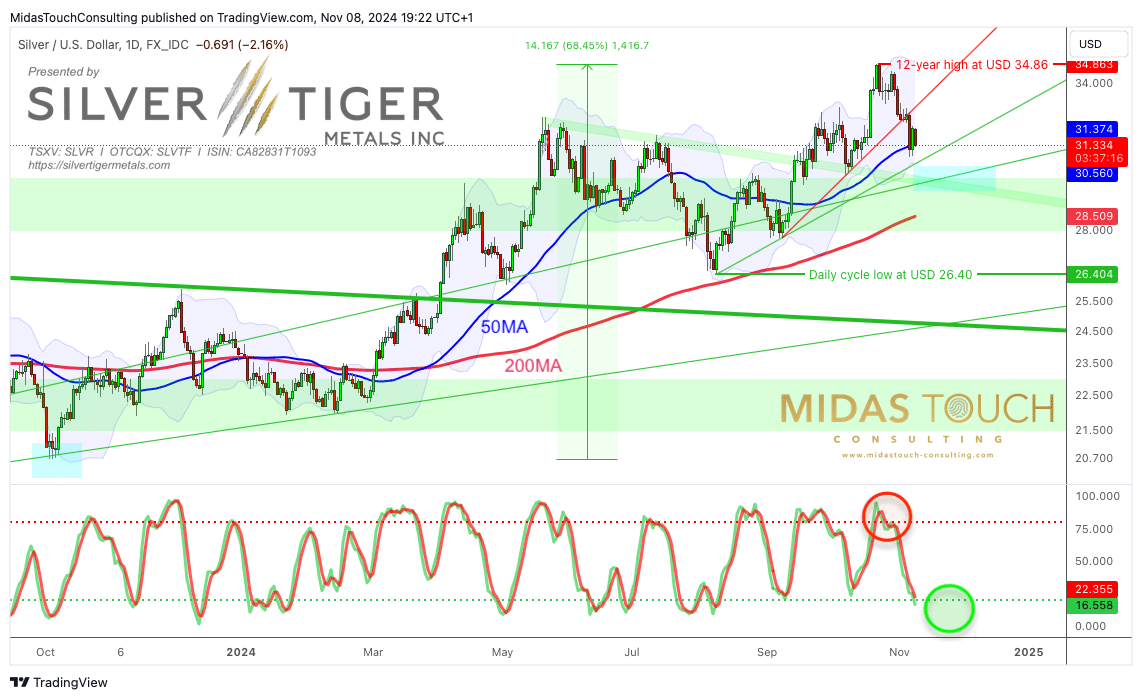

Silver in US-Dollar, Daily chart

Silver in US-Dollar, daily chart as of November 8th, 2024. Source: Tradingview

On its daily chart, silver has pulled back sharply from a 12-year high at USD 34.86. The 50-MA (USD 31.37) as so far absorbed the sell-off, but silver will likely close this week slightly below it. Should this moving average not be able to stopp the bears, prices around USD 30 and maybe slightly lower are to be seen soon.

On the other hand, the daily stochastic oscillator has already reached its oversold zone. Hence, a decisive break back above USD 32.50 could signal the end of the pullback already and pave the way back to test the multi-year highs around USD 35.

Conclusion: Easing War Premium Leads to Healthy Pullback

While silver hasn’t matched gold’s explosive growth, its steady climb with impressive gains in 2024 and solid fundamentals paint a promising picture for the mid- to long-term. However, the short-term price action suggests a period of consolidation. In fact, a healthy multi-week consolidation or pullback would lay the foundation for the next rise. We currently assume that latest by mid-December the uptrend will pick up momentum again. Investors should keep an eye on the USD 35 area, which represents a significant multi-year resistance level. A decisive break above this point could potentially pave the way for silver to challenge its 1980 and 2011 record high of around USD 50 by spring 2025.

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can also subscribe to our free newsletter.

Disclosure: Silver Tiger Metals is a sponsor of Midas Touch Consulting. Silver Tiger Metals has no editorial control or veto rights. Midas Touch Consulting and members of our team might be invested in Silver Tiger Metals. These statements are intended to disclose any conflict of interest. They should not be misconstrued as a recommendation to purchase any share.

This article and the content are for informational purposes only and do not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.

********