Silver Global Price Forecast: The Sterling Opportunity

Precious metals were under pressure last year, but investors continued to accumulate silver while gold had a record amount outflow selling.

Precious metals were under pressure last year, but investors continued to accumulate silver while gold had a record amount outflow selling.

We can see this by looking at the physically backed iShares Silver Trust SLV is up 25 million ounces Oct. 31, 2013 since January 2013. While physical holdings in the SPDR Gold Shares GLD shrunk by 28 million in 2013.

Investment demand for silver now accounts for 24% of overall demand, up from only 4% in 2003 after the introduction of ETFs as a liquid trading source. Additionally, silver investors typically include small investors, whereas large institutional investors have steered toward gold ETFs.

Unlike gold… silver is consumed by industrial and medical usage. Silver’s relative affordability and industrial usage is helping bolster silver demand.

Silver is used in consumer electronics like touch screens found in smart phones and tablets, medical equipment. As such, silver has proven virtually indispensable in almost all electronic devices.

According to the CPM Group., industrial demand should reach 838 million ounces, up about 3% year-over-year. It is important to know that silver’s global mining production shows a pathetic 2.8% during the past 10 years, which will not be enough to supply this new electronic age we live in.

So regardless of the state of the global economy, real demand for all of these electronics, demand in the 21st century might mean that silver’s industrial demand could grow at a faster rate than mine supply in the years to come.

If we look as what Asia is doing, demand continued to grow for physical metal. We can now add other nations, like Turkey or Argentina of silver and gold purchasers. If it weren't for the fact that the Indian government has been trying to profit from its gold market with a 10% tax which has virtually stopped gold buying in India compared to what it was a couple years ago. I think gold would be trading much higher and teach the paper shorts a lesson or two regarding why gold and silver are not just commodities, but in fact are money.

In 2010 we saw India’s silver imports surge 235% over the previous year and 2010 was a huge year for silver. I feel as though the silver market is setting up for something even bigger this time around as the markets technical patterns combined with India’s 284% in silver imports last year will spark the next major rally in silver.

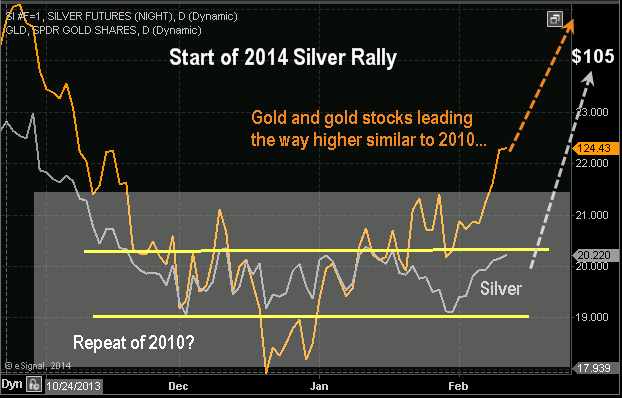

See the chart below for a visual of 2010 rally in silver.

Start of 2014 rally in silver?

The bull market in silver and gold during the 1970s took silver up 30 times and gold up over 20 times. If you were to compare the precious metals bull of the 70s with the recent bull market that began 12 years ago, we could see gold over 5,000 an ounce and silver at roughly 130.

During the metals peak in 1980 nearly everyone was trying to get some exposure to these investments. The 2011 highs do not look at all like the 1980 top, so I do not believe that we have seen the parabolic blow-off top often associated with the end of a commodity bull market.

The list of reasons to buy silver is long and diverse. Perhaps the most significant, is the need for the central banks to keep real interest rates below the rate of inflation. This is one the oldest tricks in the book to spark inflation.

Another reason I think silver should be owned is because of a possible short squeeze. The manipulation of silver is very controversial no doubt. What we do know is that the number of paper claims on physical metal has exploded over the course of the past four decades. This is probably the only fact worth focusing on and someday this will catch up with the price of silver and price could go ballistic.

Why Silver Should Rally Aggressively:

- China’s insatiable demand for the white metal continues growing

- India’s demand in 2013 more than doubled from the previous year and consumes 20% of all silver production.

- Silver’s global mining production shows a pathetic 2.8% during the past 10 years

- Yearly Consumption/Production ratio demonstrates acute deficits

- Unlike gold… silver is consumed by industrial and medical usage

- Chinese solar demand is expected to grow several hundred percent and silver is used and not easily recovered from this product.

- Investment demand for silver up 20% and will go ballistic…once the present consolidation ends

- Currency Devaluation Contagion will soon engulf the world, thus fueling all precious metals higher

- Mexico is considering making Silver the national currency…rather than the fiat peso

- Arizona and Utah legalized the use Gold & Silver As Currency and South Carolina & Colorado are going down this road

- A growing number of states are seeking shiny new currencies made of silver and gold

- Sales of US Minted Silver coins are at all-time record highs despite the recent correction in bullion value

- Silver and gold are both a commodity and financial assets

- Low interest rates in western nations bolster inflation

The Sterling Opportunities in Silver…

Silver and Gold Bull Market Comparisons and Forecast

Philadelphia Gold and Silver Index

The Philadelphia Gold and Silver Index is an index of 16 precious metal mining companies that are traded on the Philadelphia Stock Exchange. The index is represented by the symbol "XAU", which may be a source of some confusion as this symbol is also used under the ISO 4217 currency standard to denote one troy ounce of gold. The Philadelphia Gold and Silver Index and the NYSE Arca Gold BUGS Index (NYSE MKT: HUI) are the two most watched gold indices on the market.

Large Silver Stock – Pan America Silver Corp.

There are many ways to play the next silver bull market. Each has its own strengths and weaknesses. Trading the large silver companies can provide great exposure along with dividends but often the larger stocks will not provide the most upside potential.

Typically the smaller the company the higher the potential gain but keep in mind risk increases as well.

Smaller Silver Stocks

Silver Miners ETF – The Basket of Silver Stocks

The SIL silver miners ETF holds a basket of silver stocks which vary in size. This is a great way to get the best of both worlds in terms of owning all sizes of silver stocks within one investment.

Because of the large and small ownership of volatile silver stocks you can see the potential return is higher than just owning a larger silver stock.

Silver Investment Conclusion:

In reality we have no idea what the central planners will do in the year ahead. All we can do is follow the price, trends and fundamental data in hopes to profit from the precious metals market.

No matter how you cut it, price will be volatile the market will do everything it can to buck us off the next bull market. While I like to actively trade rallies and pullbacks within the market, it is critical to always hold a core position with the longer underlying bull market. Try to remember the long term.

Now that the gold and silver bull market is starting again I will be covering them much closer along with the occasional stock here and there as opportunities present themselves which I feel comfortable putting my own money into. So I plan to share my trading portfolio with subscribers of my precious metals newsletter at www.TheGoldAndOilGuy.com

Disclaimer: This material should not be considered investment advice. Technical Traders Ltd. and its staff are not registered investment advisors. Under no circumstances should any content from websites, articles, videos, seminars, books or emails from Technical Traders Ltd., or its affiliates be used or interpreted as a recommendation to buy or sell any type of security or commodity contract. Our advice is not tailored to the needs of any subscriber so talk with your investment advisor before making trading decisions.