Silver Price Forecast: Important Low Setting Up

Silver has just witnessed a rare false breakout. A false breakout is when a market overcomes a defined level of selling pressure, only to fail to hold above that level following a period of consolidation. The result after a false breakout is often lower prices; however, context is key, as the market should only be expected to fall to the next visible support level.

Silver has just witnessed a rare false breakout. A false breakout is when a market overcomes a defined level of selling pressure, only to fail to hold above that level following a period of consolidation. The result after a false breakout is often lower prices; however, context is key, as the market should only be expected to fall to the next visible support level.

In this article we will highlight silver’s recent false breakout, the expected support level it should decline toward, and the price trajectory pending following the summer low.

Silver’s False Breakout

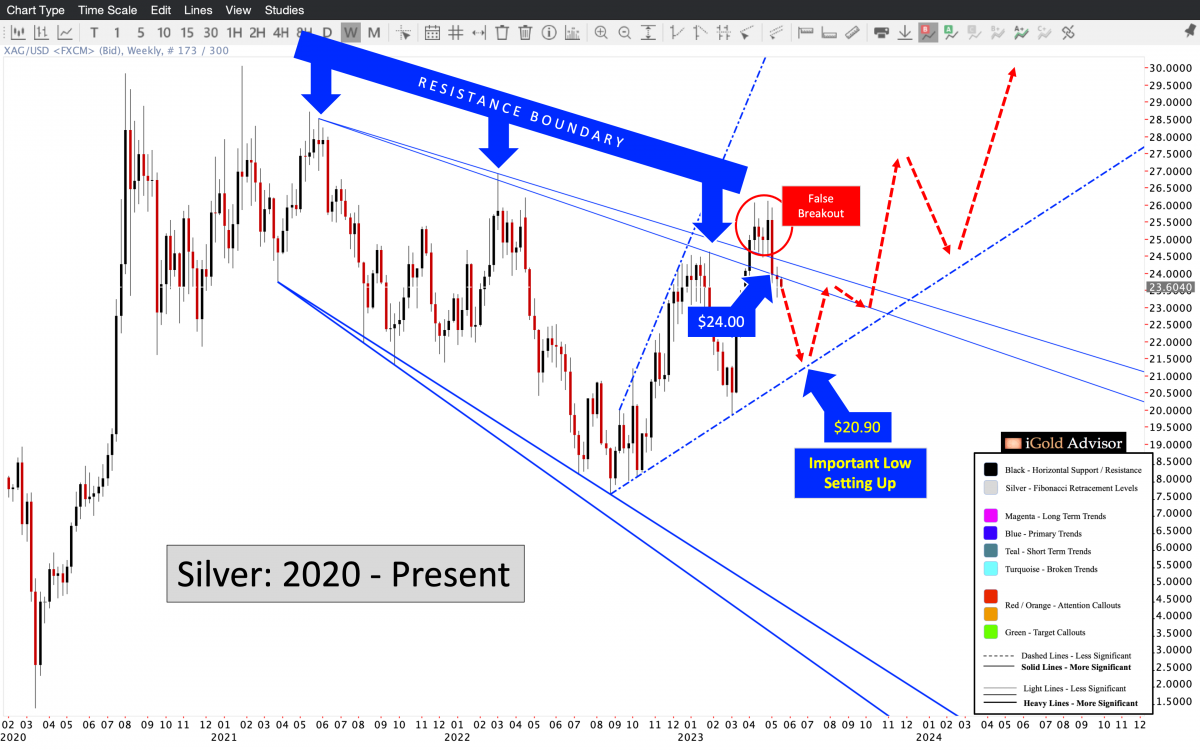

We will refer to the chart below in the following discussion:

Note the clear resistance boundary of sellers (blue) which have emerged at lower and lower price intervals, following the 2021 peak in silver.

No matter the reasons for their selling, whether legitimate or manipulative, these entities have chosen to exit their silver positions at incrementally lower prices over the last two years. This forms the resistance boundary of sellers.

Note how in April of this year, silver briefly exceeded the resistance boundary of $24.00 for several weeks (red callout). It appeared that buyers had regained control of the market, that sellers had dried up, and that a new trend of higher prices was on its way.

However, within several weeks the steadfastness of these buyers waned, and sellers emerged once again, sending prices back below the former resistance boundary. This is what we call a false breakout.

Context is Key

False breakouts can be catastrophic topping signals if they occur after a prolonged advance.

However, they can also simply be short-term topping signals if they occur within a sideways or declining trend.

In all cases, context is key.

In the case of silver, prices have been trending lower for the last two years. Thus, the false breakout is not taken to be a sign of a major long-term top forming; the signal should instead be representative of an intermediate-term top.

How Low for Silver?

How low should silver be expected to decline following this false breakout reversal?

We turn to the chart above again, to note the next significant support level of buyers which visibly appears. In this case, that level is $20.90, the rising buying trend which began at the 2022 bottom (dashed blue line). Note that this level is rising as each day passes, and so support will come in above $21.00 within several weeks.

In the case of silver, since the metal has failed to hold above the $24.00 resistance zone, we would now expect prices to fall toward the $20.90 - $21.00 support zone over the coming weeks.

What Will Come Next?

The pending low should be a significant bottom for silver prices, likely even a springboard for much higher levels throughout the remainder of 2023 and into 2024.

We must remember that gold is on the verge of breaking out into new all-time high record territory, as discussed in this recent article: https://www.gold-eagle.com/article/gold-price-forecast-new-all-time-high

Throughout history, when gold breaks to new all-time highs, silver always follows, as investors who may be hesitant to spend over $2,000 for a single ounce of gold will often see better value in buying 25+ ounces of silver for the same price. As investors “move down the food chain” to the better-valued silver, we tend to witness the silver price play catch-up to the gold price, albeit on a delayed and leveraged basis.

Thus, in the case of silver today, we expect that the pending low toward $20.90 - $21.00 may represent the final bottom before silver prices move sharply higher, and certainly above the 2020 peak of $30 per ounce. In this recent article, we discussed our eventual silver target once the precious metal breaks above the $30 level: https://www.silver-phoenix500.com/article/silver-price-forecast-44-50-silver-following-breakout

Takeaway on Silver

Silver has witnessed a false breakout above $24.00 in recent weeks. False breakouts tend to be forebearers for reversals lower.

However, context is key. While a false breakout after a multi-year advance would be the sign of a major top, a false breakout amidst a declining trend simply means a more moderate decline would be expected now toward the next visible support level. In the case of silver, the next clear zone of support is in the $20.90 - $21.00 region.

Following this low, silver may be on the verge of a powerful move higher, coinciding with gold’s breakout to new all-time highs.

At www.iGoldAdvisor.com, we are preparing to purchase several precious metals-related investments. In addition to bullion, we are making highly-leveraged investments in gold and silver mining companies via private placements, which offer investors free warrants in addition to their shares. We publish independent research and also offer individual consultations with investors – supporting both complete beginners as well as experienced investors looking to diversify exposure within the precious metals complex.

Investors should be using any weakness over the summer months to prepare for the likelihood of a major bottom in silver prior to a strong move higher in prices into 2024.

********