Silver Stocks Lead Horse

Super Force Signals A Leading Market Timing Service We Take Every Trade Ourselves!

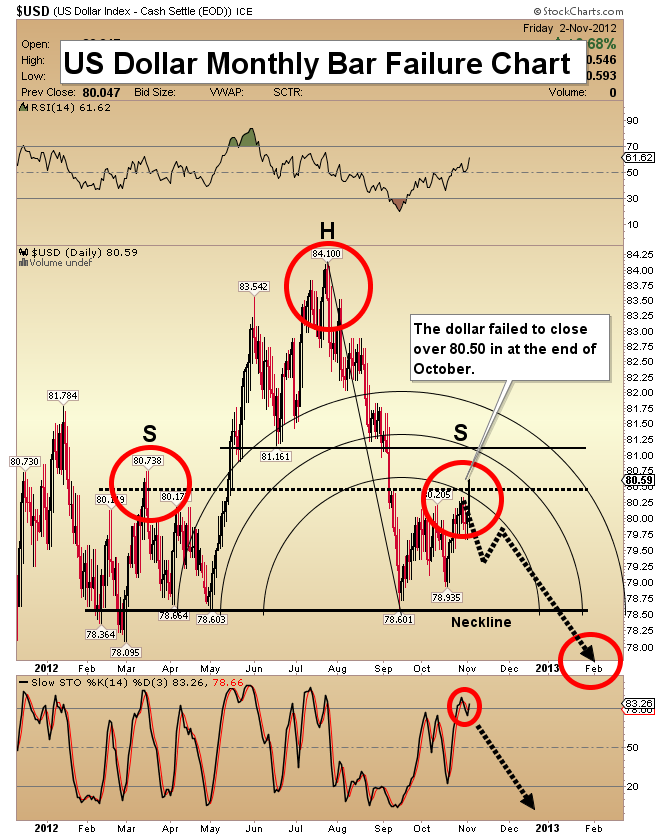

US Dollar Monthly Bar Failure Chart

- In the past, an increase in liquidity simply meant lowering interest rates. Since 2008, it has meant quantitative easing.

- The market that is most supported in this venture is US treasury bonds. By purchasing government debt, the US central bank keeps bond prices high. Interest rates are already at rock bottom lows.

- The market that will be most damaged by these bond purchases is the US dollar. The destructive action of quantitative easing is somewhat hidden, because other central banks are also damaging their own "contra dollar" currencies.

- Technically, the US dollar is somewhat overbought, and the countertrend rally is failing. Note the slow Stochastic on the chart. The key number is 80.50 and an additional monthly close below that key level sets the stage for a substantial downside move.

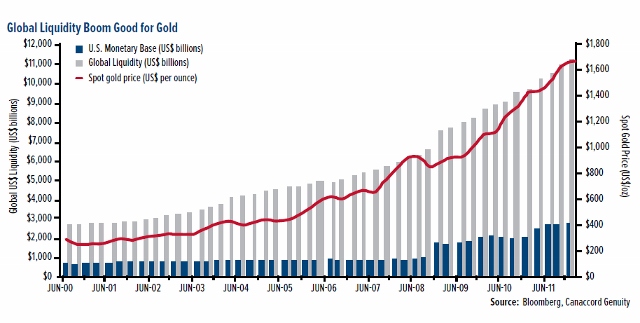

Global Liquidity Boom Chart

- This chart, from Bloomberg News, demonstrates how bullish the current environment is for gold. Gold is a limited resource. Fiat currencies are based upon government promises. As central banks continue to print money, and add it to the banking system, much higher gold prices are very likely.

Gold Stokes Chart

- My slow Stochastics indicator is now flashing a solid buy signal. I never use it alone, but it is providing powerful confirmation of my other technical work.

- Note the size of the previous rallies with the Stokes in a similar position to where it is now.

Gold Arc Chart

- Seasonal analysis suggests that gold is due to rally, until the end of the year. The current position of gold on the Fibonacci arc chart supports this thesis.

- The rising CCI indicator is also predicting a solid move to the upside.

- My targets are $1850 and $2015 for gold, and timeline analysis suggested that $1850 would be achieved by mid-November. Due to the US election, the natural flow of the market has been interrupted.

- The good news is that I only see the move to $1850 being delayed by about two weeks.

- Once the $1800 area is penetrated, new highs could be captured within days or hours. The market may have one more quick punch lower, but the next major move is to the upside.

GDX Arc Repetition Chart

- This chart is a broader approach to Fibonacci Arc analysis. Note the similarity of the blue buy zone circles.

- My target for GDX is $66. When gold rises beyond the $1800 area, the entire sector could move with great velocity. If that is the case, then GDX could rise to $72, before the end of the year.

GDX Swing Trader Chart

- Please note the gap on this chart at the base of the black arrow, near $51.40. I expect any spike lower to halt there.

- Short term traders should place buy orders there, with an upside target of $53.40.

GDXJ Pennant Breakout Chart

- GDXJ is breaking out to the upside, from the pennant formation that I highlighted last week. I want to see this breakout hold, for a minimum of two days, on strong volume.

- Volume will be lighter than normal, due to the recent storm that hit New York, which makes interpretation difficult. Regardless, I need to see volume start to trend higher, to be sure that we've seen the lows of this correction.

Silver Volume-Based Support Chart

- One key tool I use to determine viable support areas is volume based support (VBS). Silver has just pulled back towards one such key VBS zone, which is good news. The current band of support extends down to $31.

Silver Stocks Lead Horse Chart

- Right now, the normally-volatile silver mining stocks are the star of the precious metals show. The incredible resiliency of silver stocks during this correction, implies that they could run like the wind once the bull trend resumes.

- A move higher in silver stocks also sets up the underlying metal, for a solid move to the upside.

Please note the position of the MACD indicator, as well as the very bullish volume pattern. Silvers stocks, and silver, may be about to soar!

Unique Introduction For Gold-Eagle Readers: Send me an email toalerts@superforcesignals.com and I'll send you 3 of my next Super Force Surge Signals, as I send them to paid subscribers, to you for free. Thank-you!

Stay alert for our Super Force alerts, sent by email to subscribers, for both the daily charts on Super Force Signals at www.superforcesignals.com and for the 60 minute charts atwww.superforce60.com

About Super Force Signals:

Our Super Force signals are created thru our proprietary blend of the highest quality technical analysis and many years of successful business building. We are two business owners with excellent synergy. We understand risk and reward. Our subscribers are generally successful business owners, people like yourself with speculative funds, looking for serious management of your risk and reward in the market.

Frank Johnson: Executive Editor, Macro Risk Manager.

Morris Hubbartt: Chief Market Analyst, Trading Risk Specialist.

trading@superforcesignals.com

trading@superforce60.com

Super Force Signals

422 Richards Street

Vancouver, BC V6B 2Z4

Canada