Trump Wants Interest Rate Cuts; Be Careful What You Wish For!

President Donald Trump is pushing hard for interest rate cuts.

He should be careful what he wishes for, because he is begging for more inflation.

Literally.

Trump started badgering Federal Reserve Chairman Jerome Powell about rate cuts even before his inauguration, saying last January that “interest rates are far too high.”

In fact, this running battle with Powell over rates dates back to Trump’s first term. As the Fed finally tried to normalize rates in 2017 after holding them at zero for nearly a decade in the aftermath of the 2008 financial crisis, Trump frequently criticized Powell and urged him to lower rates.

Trump got his wish after the economy became shaky and the stock market crashed in the fall of 2018. The Fed reversed course and began cutting rates. Even then, Trump wasn't happy. He wanted deeper cuts. When the Fed only delivered a 25-basis point rate decrease in September 2019, Trump went after Powell on Twitter (now X) even though the interest rate was only at 2 percent.

“Jay Powell and the Federal Reserve Fail Again. No ‘guts,’ no sense, no vision! A terrible communicator!”

With the stock market in freefall and many analysts now worried about a looming recession due to fallout from the trade war, Trump has doubled down on his demands for lower interest rates and has ramped up his rhetoric against Powell. In a Monday post on Truth Social, Trump said many people are calling for “preemptive cuts” and claimed there is “virtually no inflation.”

"With these costs trending so nicely downward, just what I predicted they would do, there can almost be no inflation, but there can be a SLOWING of the economy unless Mr. Too Late, a major loser, lowers interest rates, NOW.”

Why Does Trump Want Rate Cuts?

As already noted, Trump's push for low interest rates is nothing new. He recognizes the stimulative effect of easy money.

After all, he is a real estate developer. He knows that when rates are low and borrowing is easy, people can get loans and build things.

He also knows that a trade war could push the economy into recession. He’s likely calculated that he can negotiate better trade deals before that happens, but he wants the safety net of “preemptive” cuts.

This kind of "stimulus" mentality comes straight out of the Keynesian economic playbook. If there is economic weakness, the prescription is easy money and fiscal stimulus. Trump seems to hope that by starting that process now, he can avoid an economic downturn should winning the trade war take longer than expected.

Rate cuts could also slow rising Treasury yields. The recent breakdown in the bond market is problematic for a government that needs to borrow a lot of money. The U.S. is already paying more than $1 trillion per year just to service its debt. Very few people will say it out loud, but the federal government needs lower rates to facilitate its borrowing and spending habits.

In one sense, Trump is right.

This debt-riddled bubble economy can’t keep limping along in this higher interest rate environment. This is precisely why the Fed delivered a third rate cut last December while simultaneously jawboning about caution and trying to dampen expectations of more rate cuts in 2025.

It’s not just about the trade war, either. The president inherited an economic bubble pumped up by decades of Federal Reserve monetary malfeasance. And as a recent Reuters article succinctly put it, “The bubble economy is inherently fragile.”

It is certainly reasonable to argue that an economy addicted to easy money could use lower interest rates.

But there is another consideration.

The Inflation Side of the Coin

As I mentioned, the Federal Reserve is the prime culprit behind this big, fat, ugly bubble economy.

The Fed creates bubbles by injecting money directly into the economy through quantitative easing (QE). But it also increases the money supply indirectly by keeping interest rates artificially low and incentivizing debt.

Because we have a fractional reserve banking system and lenders don’t have to back their loans with 100 percent reserves, every new loan creates new money out of thin air. In effect, if a bank has $10, it can loan somebody $100.

Whether it’s accomplished through QE, low rates, or both, this money creation is, by definition, inflation, and this inflation of the money supply blows up bubbles.

What about Trump’s assertion that there is “virtually no inflation?”

He can plausibly make this argument because the last CPI report was much cooler than expected. Prices fell month-on-month, and the annual CPI was 2.4 percent, as close to the 2 percent target as we’ve seen in a long time.

But keep in mind that even when we see a “Goldilocks” CPI of 2 percent, prices are still going up by that amount every single year.

Furthermore, the CPI only measures price inflation. Rising prices are just one symptom of monetary inflation – the increase of money and credit.

When most people hear “inflation,” they think of rising consumer prices. This is exactly what Trump meant by the term. But inflation typically shows up in financial markets first. Monetary inflation blows up asset bubbles in stocks, real estate, art, and other sectors. That's exactly what happened during the Fed’s easy money spree during the Great Recession. But the full effects didn’t hit consumer prices until the Fed doubled down on its monetary binge during the pandemic.

Consider the amount of inflation the Fed has created since the 2008 financial crisis. It pumped over $9 trillion into the economy through QE alone. On top of that, it suppressed interest rates for well over a decade.

That’s a tidal wave of inflation, and it blew up some mighty big bubbles. It also created a lot of malinvestments in the economy.

The Fed managed to cool down CPI with its rate increases and balance sheet reduction, but I’ve been saying for months that it never did enough to slay the inflation dragon.

Even so, the Fed has effectively ended the inflation fight. Keep in mind, the central bank has already cut rates three times, and it has drastically slowed balance sheet reduction.

And the fact is, monetary inflation has been on the upswing for well over a year.

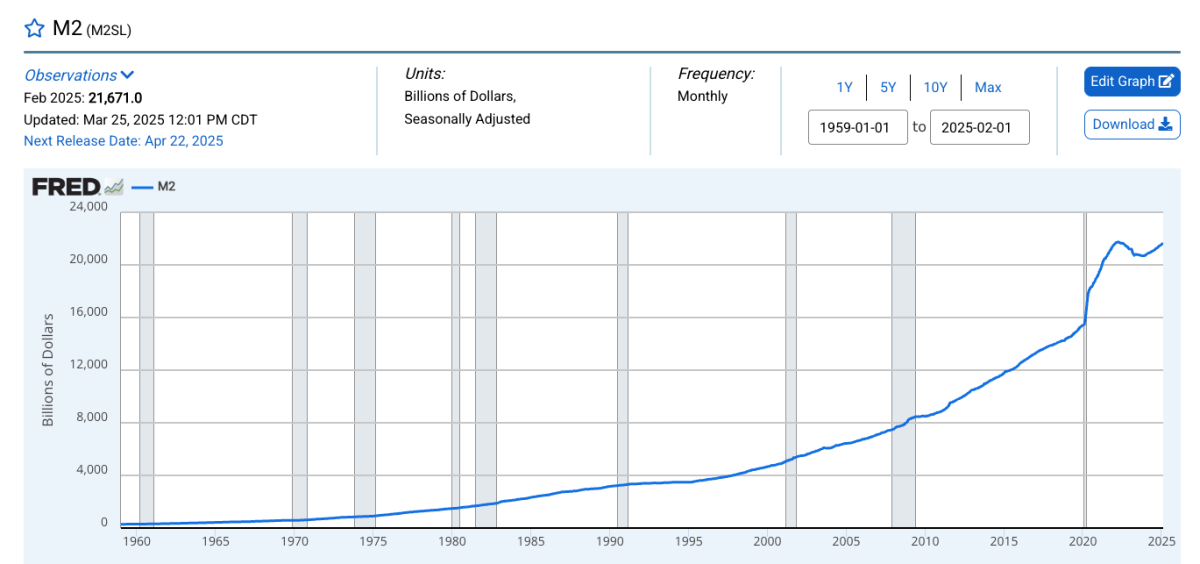

We see this in the M2 money supply. It bottomed a little over a year ago at $20.60 trillion. Since then, it has crept upward. As of February, it was at $21.67 trillion. That’s the highest level since June 2022 and approaching the all-time high of $21.72 trillion hit in the spring of that year.

We also see the ramp-up in inflation in the Chicago Fed National Financial Conditions Index. By this measure, monetary policy has been historically loose for months.

As of the week ending April 11, the NFCI stood at -0.42. A negative number reflects historically loose financial conditions.

Now, Trump wants even more looseness!

And the truth is, the markets want more looseness, too.

Even if they won’t say it out loud, everybody knows this economy is doomed without easy money.

But the fact remains that inflation is still a problem.

This is why I’ve been saying for months that the Fed is in a Catch-22. It needs to keep rates higher for longer (and I would argue it needs to raise rates) to deal with the underlying inflation problem (cooler CPI notwithstanding), and it simultaneously needs to cut rates to keep the bubble economy afloat.

Good luck with that.

Powell & Company has apparently decided the best course of action for now is inaction. They are taking a “wait and see” position, much to Trump’s chagrin.

However, at some point, the economy will force their hand.

It wouldn’t surprise me if the Fed delivered a 25-basis point cut in May or June. After all, it has the green light from the CPI report, and the stock market is a mess.

But at some point, it will become undeniable that the bottom has fallen out and the bubbles have popped. That’s when we’ll see deep rate cuts (likely back to zero) and more rounds of quantitative easing.

In other words, Trump will get his wish sooner or later.

But he needs to be careful what he wishes for because opening the inflation flood gates will inevitably lead to rising prices.

And with the dollar already weakening, we could be setting the stage for stagflation with rising prices and weak economic growth.

********