Gold rally fades, silver shines: is it time to switch metals?

LONDON (November 7) The sharp fall in gold prices on Wednesday could mean that the rally seen in recent months is tapering off.

After the decisive election outcome in the US, gold prices have scaled back below $2,700 per ounce.

The swift and decisive outcome of the election result effectively removed the uncertainty premium that had been supporting gold prices in recent weeks.

The election outcome marks the extraordinary return of Republican Donald Trump to the White House.

The dollar index surged after Trump’s victory, and rallied to its highest point in four months on Wednesday.

This put immense pressure on commodity prices, especially gold.

A stronger dollar makes gold more expensive for overseas buyers, limiting demand for the yellow metal.

Dhwani Mehta, analyst at Fxstreet, said in a report:

Trump’s policies on immigration, tax cuts and tariffs are expected to put upward pressure on inflation, Wall Street stocks, US Treasury bond yields and the USD.

The return of Trump led to more risk aversion in the market.

As risks to financial markets declined, gold’s safe-haven appeal was affected.

“These expectations from the Trump administration and their likely implications on the economy spelt doom for the non-yielding Gold price, smashing it about $100 from the static resistance of $2,750,” Mehta said.

Weaker demand for gold in 2025

Gold has been one the best performing asset class among precious metals in 2024.

Prices have risen 33% since the beginning of the year to reach $2,800 per ounce level for the first time.

Analysts, however, expect demand for gold to slow down in 2025 and 2026.

“Demand from central banks and jewelry production, which together account for about two-thirds of global gold demand, is likely to ease over the forecast horizon due to record-high prices,” analysts at World Bank said in a report.

“Gold prices are expected to increase by 21 percent in 2024 (y/y) and remain around 80 percent higher than their 2015-2019 average throughout the forecast period, edging down by just 1 percent in 2025 and 3 percent in 2026.”

Though gold prices may continue to outperform the broader sector, record high prices are expected to eat into demand for jewellery, analysts at the World Gold Council said.

In the September quarter, jewellery demand for gold fell sharply.

Jewellery consumption in the third quarter fell 12% on year to 459 tons as the gold price reached a series of successive new highs, imposing affordability constraints on consumers, according to WGC’s data.

The sharp rise in gold prices have crippled China’s jewellery demand for the quarter. Demand fell as much as 33% from last year to 102.5 tons.

More potential for silver

Analysts at the World Bank see greater potential for silver as they expect rising demand and limited supply.

Silver demand is expected to grow steadily over the forecast horizon, fueled by its dual financial and industrial uses.

With modest supply growth lagging behind strong demand tailwinds, silver prices are projected to rise by 7 percent in 2025 (y/y) and 3 percent in 2026, following an expected 20 percent increase in 2024.

Silver prices have climbed 35% since the start of the year, and have outperformed gold prices in the recent weeks.

Moreover, silver’s use in industries presents an opportunity for greater demand for the metal during the next couple of years.

Also, silver continues to be undervalued as compared with gold.

According to experts, silver prices have more potential for an upside in the upcoming months among all other precious metals.

Short-term hurdle for silver

Even though experts are bullish on upside potential for silver, Wednesday’s decline has led prices below the key support of $32 per ounce.

After Trump’s victory on Wednesday, the dollar and Treasury yields surged, dragging down demand for the non-yielding metal.

Analysts at Fxstreet said that the next hurdle for silver on COMEX is around $31.40 per ounce level.

If prices breach the level of $31.40 per ounce, then silver could trace back above $32 per ounce, according to Fxstreet’s Mehta.

Mehta added:

Any further move up, however, might be seen as a selling opportunity and runs the risk of fizzling out rather quickly near the ascending channel support breakpoint, around the $32.65 region.

Mehta believes if the pivotal point of $32.65 is breached, then prices could find their way back above $33 towards the static resistance around $33.70 per ounce.

Silver prices on COMEX had touched an over 12-year high of $35 per ounce in October.

Gold and silver market focus on Fed meeting

As the dust settles on the US Presidential election, traders were eagerly waiting for the outcome of the Federal Reserve’s policy meeting later on Thursday.

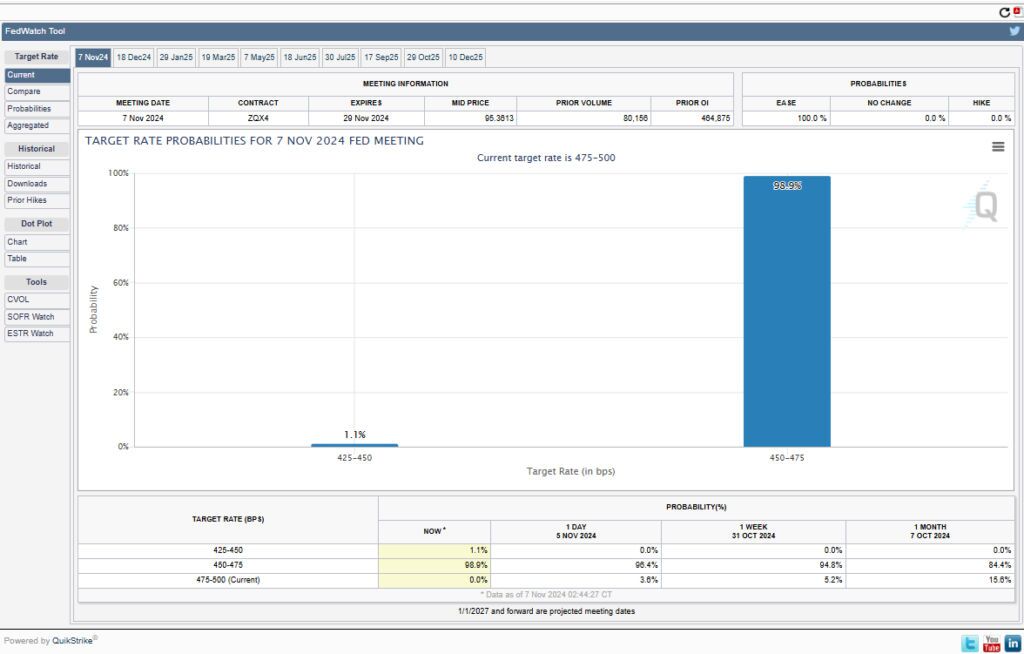

According to the CME FedWatch tool, traders have priced in a 98.9% probability of the US central bank cutting interest rates by 25 basis points at its November meeting.

Source: CME Group

Source: CME Group

This will follow the Fed’s decision to cut rates by 50 bps at its September meeting.

Though the scale of the rate cut is not as large as the previous meeting, lower interest rates are beneficial for the bullion market.

“Donald Trump’s return to the White House could prompt the Fed to slow down on its easy cycle, as his expansionary fiscal policies are seen as highly inflationary,” Fxstreet said in a report.

Invezz