Silver And Gold Ratios

The silver to gold ratio (SGR) reached a new high of the move last Monday (June 10th) of 66.23 ounces of silver to one ounce of gold. This is a huge retracement from its low of 32.00 to an ounce of gold on 25 April 2011. Today, an ounce of gold can purchase twice as much silver as it could 26 months ago. Sounds like a good time to exchange some gold for silver.

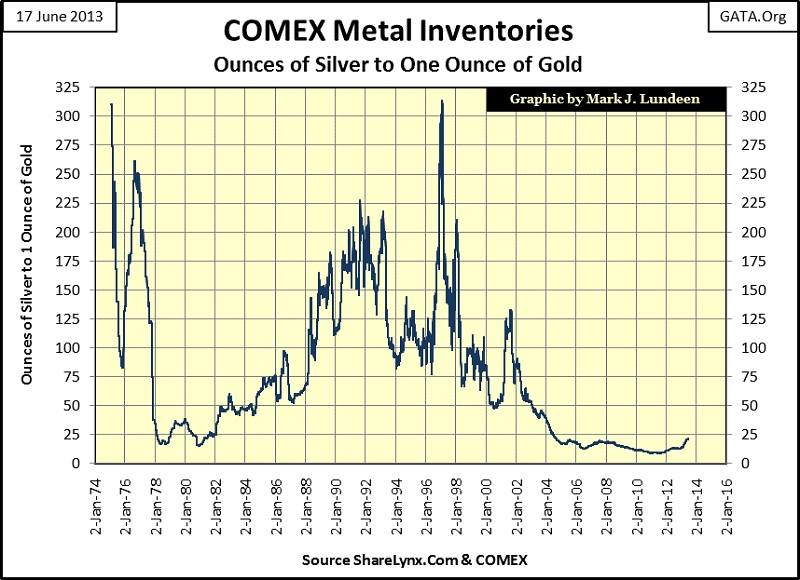

The SGR may continue increasing for a while, but we must be near the point where it will resume its bull-market decline. It’s hard to make the case that there are 60 ounces of silver available for each ounce of gold available in the global inventory. For instance, look at the gold and silver inventory for the COMEX metals markets below. Currently they have 21.36 ounces of silver on hand for each ounce of gold stored. Is the availably of silver compared to gold any better in London at the LBMA? It might be but I doubt it is much better in London than it is in New York.

This is an interesting chart. It uses total metal stored, which includes both register and eligible categories at the COMEX. It’s clear that after the 2001 start of the gold-bull market something happened with the COMEX inventories. Since 1975, no other decade long period has this ratio just laid down and stayed there. In 2001, this ratio was over 125 ounces of silver for each ounce of gold stored at the COMEX. It then steadily declined to below 25 ounces of silver in 2004 and has stayed there for the past nine years. Like the price movements in the gold and silver market, this looks strange.

There is one more silver to gold ratio we should be aware of, how many ounces of silver are sold for each ounce of gold sold by dealers to the public. Unfortunately I don’t have any data to plot. But every weekend I listen to King World News’ Weekly Metals Wrap, and Bill Haynes of CMI Gold and Silver usually speaks of how many ounces of silver he sells to his clients for every ounce of gold CMI sells, and frequently CMI sells 50 ounces of silver for each ounce of gold. That is a lot of silver, and that is just for retail demand. Industry also has a huge appetite for silver that is almost never quantified in the media, but that doesn’t mean it’s not there, or won’t be critical when push comes to shove between investment and industrial demand for silver sometime in the future.

I don’t care to predict when gold and silver will resume making new highs. But when they do I expect silver’s price gains to be spectacular.