Gold-Silver Ratio Over 103 Indicates Silver Is Still on Sale!

As gold marches ever higher, silver continues to lag, like a kid more interested in sniffing flowers than keeping up with his parents’ pace.

Don’t get me wrong. Silver hasn’t done horribly so far this year. It is up a little over 12 percent. However, it has failed to close the gap with gold, and that has many investors questioning what’s going on with the white metal.

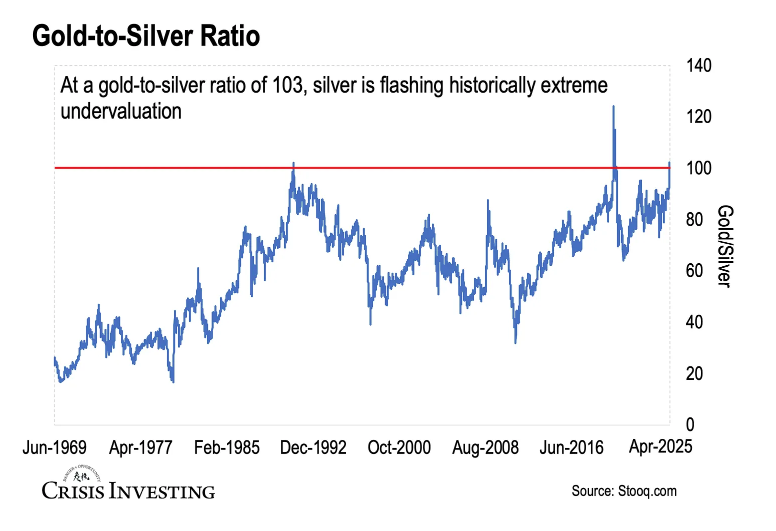

As of this morning, the gold-silver ratio was just over 103:1. That means it takes about 103 ounces of silver to buy an ounce of gold.

This is slightly above the 1991 peak and not too far below the all-time high of 123:1 during the pandemic chaos in 2020.

In other words, this is an extremely wide spread from a historical perspective and indicates that silver remains drastically underpriced compared to gold.

More significantly, these extremely wide gold-silver ratios don’t tend to last long. They eventually snap back to the mean. And when that happens, it’s generally a very fast move.

Historical Gold-Silver Ratio Perspective

Mining industry geologists estimate there are somewhere between 19 and 20 ounces of silver for every ounce of gold in the earth. This provides a natural starting point for a gold-silver ratio of 20:1.

From a mining perspective, annual silver production averages around 800 million ounces per year, and gold production is a little over 100 million ounces. (These are rounded numbers.) That would give a gold-silver ratio of around 8:1.

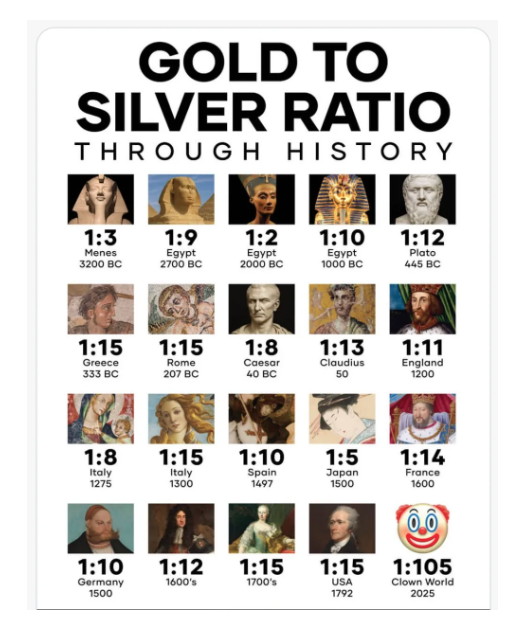

Analyst Lau Vegys included a chart in a recent article published on Doug Casey’s Crisis Investing website that provides some perspective on the gold-silver ratio. As he noted, “While I don't have precise data going back centuries, I recently stumbled upon a graphic circulating on X that really drives home just how unusual today’s silver (under)valuation is. Although I haven't verified every data point myself, it broadly aligns with historical accounts.”

We do know that governments have set gold-silver ratios to control the value of their coinage for centuries. The earliest recorded imposed gold-silver ratio was by King Menes of Ancient Egypt when he set the ratio at 2.5:1.

The U.S. Congress fixed a gold-silver ratio of 15:1 in its 1792 Coinage Act. This compares to a 15.5:1 ratio set by France in 1803.

A bi-metallic monetary system proved to be unwieldy, and European countries began to demonetize silver in the mid-19th century. The U.S. followed the lead of England, Portugal, Germany, and other nations and established a gold standard in the Coinage Act of 1873.

The demonetization left the gold-silver ratio to float freely. By World War II, the gold-silver ratio had spread to as much as 40:1.

In the modern era, the gold-silver ratio has averaged around 60:1.

Returning to the Mean

As I already mentioned, when the gold-silver ratio gets way out of whack, it eventually snaps back to the average.

From a historical perspective, when you see gold-silver ratios well above that historical average, it tells you that silver is underpriced compared to gold, and there is a strong possibility that silver will go on a bull run to close that gap. Historically, this has often happened in the midst of a gold bull rally, with silver outperforming gold. (Of course, past performance does not guarantee future results.)

Vegys noted this as well.

“Historically, extreme ratio levels—like 103 right now—have often preceded significant reversals, with silver typically outperforming gold as the ratio reverts toward its average. A clear recent example was March 2020: after spiking above 120, silver more than doubled within just five months, substantially outperforming gold.”

When it was all said and done, the ratio was back to 60:1.

We’ve seen even more dramatic snapbacks in the past. The gold-silver ratio fell to 30:1 in 2011 after rising to over 80:1 during the money creation of the Great Recession in the wake of the 2008 financial crisis.

Some people have suggested that the gold-silver ratio has broken down. It has been well above the 60:1 average for well over a year. However, nobody has been able to point to any structural change in the gold and silver markets to explain such a breakdown.

Vegys suggested three reasons why the gold-silver ratio tends to return to the mean.

- The silver market is relatively small—roughly a tenth the size of gold's—which means even modest capital inflows can move the price dramatically.

- Silver tends to be more volatile, often behaving like a leveraged version of gold. During bull markets, it usually outpaces gold significantly.

- Unlike gold, about half of silver's demand is industrial. As economic activity rebounds after downturns, this industrial usage picks up, providing additional price support.

It’s worth noting that the supply and demand fundamentals are extremely strong for silver.

Industrial demand set a record in 2024, driving the fourth straight annual market deficit. Gold demand outstripped supply by 148.9 million ounces. That drove the four-year market shortfall to 678 million ounces, the equivalent of 10 months of mining supply in 2024.

And this was with tepid investment demand. When investors get in on the action, that supply-demand gap could explode.

Silver isn’t priced for these market dynamics.

Vegys sums up the situation this way:

“Here’s the bottom line. With the gold-silver ratio at such an extreme level, silver looks set for a potential catch-up rally. If the ratio just moves back to its long-term average of 60, silver would need to rise about 70 percent relative to gold. That’s an increase of nearly $23 per ounce from current levels. And if gold keeps climbing too, silver’s upside could go from big to explosive.”

He also makes an important point to those who speculate that the gold-silver ratio has somehow become irrelevant.

“Extremes can last longer than you'd expect, and history doesn’t guarantee what comes next. But at these levels, silver’s risk/reward looks pretty compelling.”

The bottom line is that silver appears to be on sale. Not to sound like a TV huckster, but these prices probably won't last. Now is the time to take advantage of this historically wide gold-silver ratio. Nobody knows when it will snap back to more normal levels, but if history is any indication, it will. And when it does, it will happen fast.

********