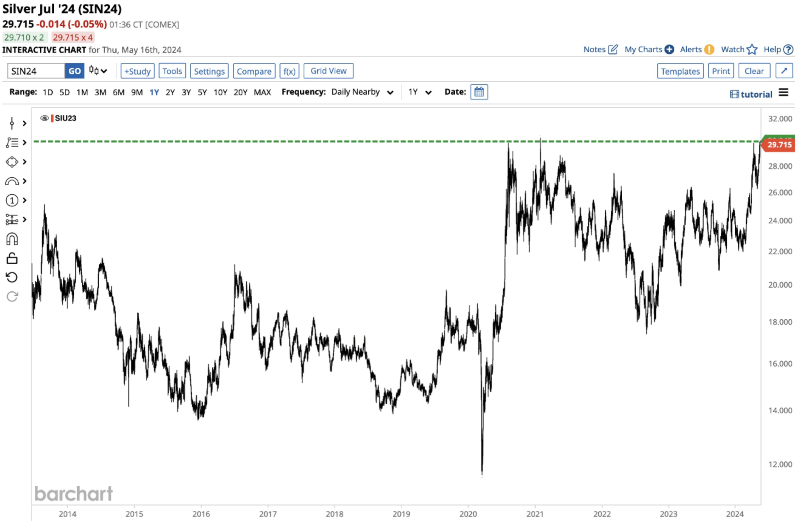

Silver on the brink of highest price in more than a decade

NEW YORK ( May 16 ) As silver enters its fifth consecutive year of supply deficit, intensified by heightened demand in technology and renewable energy sectors, and analysts predict it breaking the $30 resistance, the precious metal is, indeed, moving toward price levels last witnessed over a decade ago.

Specifically, the recent United States inflation report coming in a bit cooler than expected has triggered a bullish rally for silver and gold prices, with the former on the brink of its highest level in more than a decade, according to the observations shared by markets analyst Barchart in an X post on May 16.

Silver price chart since 2014. Source: Barchart

Silver price chart since 2014. Source: Barchart

Indeed, silver reached its all-time high (ATH) price of $49.51 per ounce in April 2011, after which it consolidated in the $35 area, where it more or less remained during 2012, and then proceeded to decline toward the $20 level, ranging below it until late 2020, and making a stronger push in recent weeks.

More recently, silver rose above the $29 per ounce mark, hovering at one-month peaks, influenced by the fresh economic data reigniting expectations of the US Federal Reserve (Fed) cutting interest rates this year, and is currently changing hands at the price of $29.54.

Silver price analysis

Notably, its price at press time represents a decrease of 0.72% in the last 24 hours, an advance of 8.85% across the previous seven days, as well as a 5.31% gain on its monthly chart, according to the most recent data retrieved by Finbold on May 16.

Silver price 7-day chart. Source: SilverPrice.org

Silver price 7-day chart. Source: SilverPrice.org

So, how much is a kilo of silver worth at the moment? Right now, silver measured in kilograms is worth $948.99 per kilogram, which is about equal to one traditional poured silver bar – a popular choice among investors for storing their silver holdings.

Meanwhile, US economist Peter Schiff observed that gold and silver had “better fundamentals and technicals than any other sector” but that investors were “still hesitant to buy gold and silver mining stocks” because the “long-term bear market has left them gun shy” and “suspicious of every rally.”

It is also worth noting that Bloomberg’s senior commodities strategist Mike McGlone has earlier voiced optimistic prognoses for the price of silver, arguing it was only a matter of time before silver breaks the $30 resistance and continues further upward.

FinBold